All United States articles – Page 191

-

Article

ArticleOSHA will handle antitrust, AML retaliation claims from whistleblowers

The Occupational Safety and Health Administration will oversee worker retaliation claims for two new categories of whistleblowers—antitrust and anti-money laundering.

-

Article

ArticleSEC policy reversal puts settlement/waiver pairing back in spotlight

Acting SEC Chair Allison Herren Lee announced the Enforcement Division will no longer recommend to the Commission a settlement offer that is conditioned on granting a waiver, abruptly ending a policy that began under former Chairman Jay Clayton.

-

Article

ArticleDone right, outsourcing compliance can be rewarding

Should you consider outsourcing some of your firm’s compliance functions? Perhaps, even, all of them? The answer is complicated and requires a thorough analysis of the risks and rewards.

-

Article

ArticleCisco Systems investigating ‘self-enrichment scheme’

Technology conglomerate Cisco Systems said in a regulatory filing it is investigating allegations of a “self-enrichment scheme” involving former employees in China and potentially Foreign Corrupt Practices Act violations.

-

Article

ArticleSEC sues Morningstar for disclosure violations, internal control failures

The SEC has filed a civil action against Morningstar Credit Ratings alleging the former credit ratings agency violated disclosure and internal controls provisions of the federal securities laws in rating commercial mortgage-backed securities.

-

Article

ArticleA critical look at pandemic-related executive compensation changes

With 2021 proxy season underway, a new analysis by Compensation Advisory Partners reveals what impact proxy advisory firm Institutional Shareholder Services will have on say-on-pay concerning executive compensation actions made in response to the pandemic.

-

Article

ArticleSurvey: Firms enhanced cybersecurity in 2020, but not enough

Companies forced to pivot to remote work in a global health crisis spent the bulk of 2020 grappling with heightened cyber-security risks. A year later, compliance practitioners say their companies’ cyber-security postures are better for it—even in the wake of the stunning SolarWinds hack.

-

Article

ArticleMurphy Oil, Marathon Oil ESG incentives a positive step for oil industry

The willingness of Murphy Oil and Marathon Oil to adjust their executive compensation frameworks, in part, to better align with their environmental targets is a rarity in the oil and gas industry and deserving of credit, writes Jaclyn Jaeger.

-

Article

ArticleNational Holdings nears settlement with former chief compliance officer

National Holdings has reached a proposed settlement in a lawsuit filed by a former chief compliance officer who alleged she was fired for investigating insider trading by the brokerage firm’s executives, although the firm denies the allegations.

-

Article

ArticleFormer FBI Director James Comey to speak at two upcoming CW events

Compliance Week is pleased to announce James Comey will be joining two key virtual events this year—“Financial Crimes: Risks, Trends, and Proven Practices” from March 30-31 and “Compliance Week 2021” from May 11-13.

-

Article

ArticleFASB advances goodwill triggering event standard update

The Financial Accounting Standards Board ruled tentatively to move forward with and expand the scope of its proposed standard update regarding goodwill triggering events under Topic 350. The standard is expected to be finalized in March.

-

Article

ArticleACAMS survey: FinCEN Files leak a positive for financial industry?

Many compliance professionals in the financial industry believe last year’s leak of 2,100 suspicious activity reports from FinCEN had an overall positive impact on global efforts to fight financial crime, according to an ACAMS survey.

-

Article

ArticleCompanies not reporting ESG initiatives are in the minority

Several reports highlight the growing trend of companies recognizing the value of aligning their business models with ESG concerns, acceding to the demands of shareholders, activists, the market, and the public.

-

Article

ArticleSEC requests independent monitor in GPB Capital case

The SEC has requested the appointment of an independent monitor to oversee GPB Capital Holdings amid allegations the asset management firm defrauded more than 17,000 retail investors in a “Ponzi-like” scheme.

-

Article

ArticleSEC expands number of staffers authorized to launch investigations

The acting head of the Securities and Exchange Commission has expanded the number of staff authorized to issue a formal order of investigation, perhaps a sign the agency intends to launch more cases under President Joe Biden.

-

Article

ArticleQ&A: Global Widget CCO says CBD industry at regulatory ‘tipping point’

Global Widget Chief Compliance and Legal Officer Margaret Richardson talks with Compliance Week about how the company’s focus on federal and state compliance lends to leading the way in the currently unregulated cannabidiol industry.

-

Article

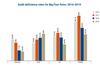

ArticlePCAOB 2019 inspection reports: Deloitte still tops; PwC deficiency rate rises again

Three of the Big Four audit firms—Deloitte, EY, and KPMG—improved their year-over-year deficiency percentage in the PCAOB’s 2019 inspection reports, while PwC’s deficiency rate increased for the third straight year.

-

Article

ArticleClover Health facing SEC probe over short-seller report

The Securities and Exchange Commission has launched an investigation into Clover Health Investments in response to scathing allegations made against the Medicare provider by short-seller Hindenburg Research.

-

Article

ArticleThe great privacy race? Apple, Facebook pitch data transparency

Apple and Facebook, two of the world’s most powerful companies, are jockeying over how transparent to be with their customers on whom they share users’ personal data with and what they do with it.

-

Article

ArticleFINRA report: Top risk areas for AML, cyber-security

The Financial Industry Regulatory Authority has published a new report designed to help inform member firms’ compliance programs by providing annual insights from its examinations and risk monitoring programs.