All articles by Tammy Whitehouse – Page 38

-

Article

Regulators explore what’s wrong with audit supervision

Image: Audit supervision in general and auditing firm staffing levels and management structure in particular are under scrutiny as an old question surfaces: How can audit firms improve the quality of their own systems? “There is this inference that we keep finding engagements where we think the auditing standards aren’t ...

-

Blog

PCAOB prepares new rule on outside auditors, reviews EQR standard

The PCAOB has scheduled an open meeting to consider a proposed new requirment around firms relying on others outside the principal firm to assist with audit work. The new proposal would address the lead auditor’s responsibilities with respect to those other auditors from outside the principal audit firm who participate ...

-

Blog

PCAOB delivers searing inspection report to BDO USA

BDO USA received a scathing 2014 inspection report from the PCAOB. Among the 23 audits the board selected for inspection, 17, or 74%, had issues, a record high rate among major firms. Of the 17 busted audits, 15 contained problems in both the audit of financial statements and the audit ...

-

Blog

PCAOB reports compliance with communications standard

Image: The PCAOB said it is “encouraged” that most firms have complied with Auditing Standard No. 16, a standard governing communication with audit committees, as the board found no failures to comply in 93 percent of the audits reviewed in the 2014 inspection cycle. “The communication between an audit firm ...

-

Article

New accounting rules aim to make change for unredeemed gift cards

Everybody has an unspent gift card or two around the house. Maybe you just never got to the store to use it, or maybe there’s only got a few dollars left on it and it would feel like a pain to zero it out. But unspent cards like these are ...

-

Blog

BlogFASB plans new discussion on credit impairment effective date, guidance

Image: FASB is reconsidering the planned effective date for the final standard on credit impaiment and is promising clarifications after concerns were raised by community bankers and credit unions over whether the requirements would lead to difficult and costly accounting processes and procedures. FASB Chairman Russ Golden said the board ...

-

Blog

ISACA provides guide to planning an information system audit

Internal auditors looking to get more involved in information systems audits can turn to a new white paper titled Information Systems Auditing Tools and Techniques: Creating Audit Programs, from ISACA, a global global association of professionals focused on IS audit and control. The paper outlines five steps auditors should take ...

-

Blog

FASB simplifies share-based payment accounting

Image: FASB has issued new guidance to smooth over several rough spots in the requirements around stock compensation, such as how to account for the tax consequences of share-based payments, classification of the awards as either equity or liability, and classification on the statement of cash flow. Chairman Russ Golden ...

-

Blog

SEC staff call out custom axis tag use in XBRL filings

The SEC is advising companies to take a careful look at their use of axis tags in their XBRL filings. The SEC has been studying corporate filings from 2013 to 2015 in the “XBRL format looking for problems that lead to data quality concerns, with axis tags being one such ...

-

Article

ArticleSEC fines energy company $300K over rubber stamp internal controls

Image: A recent SEC action against a company for maintaining insufficient internal controls signals a new effort from federal authorities to hold companies to higher standards when it comes to internal control material weaknesses and significant deficiencies. “This is a case that doesn’t have a punchline,” says Tom Sporkin, a ...

-

Blog

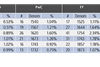

BlogNew restatement data show differences across audit firms

Research from Audit Analytics shows that even among the Big 4 there are differences in how likely a given filing will lead to a restatement. Big 4 firms were behind 44 material restatements out of 4,454 filings, for a rate of 0.99 percent. Among national firms Grant Thornton, BDO USA, ...

-

Blog

FASB appoints transition group for pending credit loss standard

Image: FASB has seated a Transition Resource Group to help implement the pending standard on credit losses that will include 16 bigwigs from accounting firms PwC, KPMG, EY, Deloitte, Grant Thornton, and Crowe Horwath, as well as banking and insurance entities. The group, which will be chaired by FASB member ...

-

Blog

Study links audit staffing to audit quality

Recent academic research from professors at the University of Alabama and Louisiana State University finds where audit engagement workload is high, companies have significantly higher abnormal discretionary accruals, are more likely to restate earnings, and are less likely to get a going concern opinion even when signs of distress are ...

-

Article

ArticleInternal audit joins the fight against cyber-threats

As organizations face ever-increasing cyber-security threats, experts are prodding internal auditors to get more involved in at least identifying the risks, even if they aren’t information technology experts. Basic compliance practices can significantly reduce a company’s cyber-exposure, but it needs somebody to drive the effort.

-

Blog

FASB complete gross versus net guidance for revenue recognition

The Financial Accounting Standards Board has issued an update to accounting standards meant to put to rest any confusion that may still exist on how to apply the principal-versus-agent guidance in the new revenue recognition rule.

-

Blog

BlogFASB issues new rules on gift cards, hedging, equity investments

FASB has issued guidance that enables companies to write off lingering gift card liabilities, shore up hedge accounting practice differences, and simplify transitions to equity method accounting. Crowe Horwath Partner James Dolinar says the guidance around gift cards is perhaps the most broadly applicable, as companies can now do some ...

-

Blog

Experts advise companies to brace for goodwill impairment scrutiny

Image: Calcbench, with their research tool powered by XBRL-gathered financial statement data, identified a number of companies posting quarterly goodwill impairments in the range of $250 million for five consecutive quarters, including Yahoo’s massive $4.46 billion impairment charge. “The total number … is trending up, from the mid-teens last year ...

-

Article

New accounting standard for leases brings numerous compliance concerns

As public companies face a 2019 deadline for a new accounting standard that brings leases onto corporate balance sheets, compliance officers will have to consider a long list of implementation decisions and business implications, says Tammy Whitehouse.

-

Blog

SEC approves PCAOB budget; Doty promises new proposals soon

Image: With majority support from the SEC—all two of them, that is—the PCAOB has finalized its 2016 budget with a 12-percent increase in fees charged to public companies to support it. Only SEC Chair Mary Jo White and Commissioner Kara Stein supported the PCAOB’s $257.7 million budget for the current ...

-

Blog

FASB wraps up revenue recognition technical decisions

FASB has determined how it wants to address questions around certain aspects of the disclosure requirements for unmet performance obligations in the new revenue recognition standard. The board plans to add a practical expedient to the disclosure requirements around certain types of variable consideration; it also will make some improvements ...