All Securities and Exchange Commission articles – Page 29

-

Article

ArticleSEC accuses Vale of safety audit manipulation in 2019 dam collapse

Brazilian mining company Vale was accused by the Securities and Exchange Commission of making false and misleading safety audit and disclosure claims prior to the January 2019 collapse of its Brumadinho dam.

-

Article

ArticleArchegos founder Bill Hwang indicted for fraud; chief risk officer pleads guilty

Bill Hwang, the founder of Archegos Capital Management, was arrested and charged with racketeering conspiracy, securities fraud, and wire fraud for orchestrating a multibillion-dollar market manipulation scheme that resulted in the U.S. hedge fund’s collapse.

-

Article

ArticleSEC hits ex-Domino’s accountant with nearly $2M insider trading penalty

A former Domino’s Pizza accountant was hit with a nearly $2 million penalty for using nonpublic earnings reports to gain an advantage in illegal trading activity, according to the Securities and Exchange Commission.

-

Article

ArticleCFTC: Ex-portfolio manager found liable in commodity pool fraud case

The Commodity Futures Trading Commission announced Edward Walczak, former portfolio manager for Catalyst Capital Advisors, was found liable by a jury for violating the Commodity Exchange Act.

-

Article

ArticleStericycle to pay $84M to resolve FCPA violations

Medical waste disposal company Stericycle has agreed to pay $84 million in civil and criminal penalties to resolve allegations it paid bribes to win government contracts in Brazil, Mexico, and Argentina.

-

Article

ArticleAnatomy of an international, $194M ‘pump-and-dump’

The Securities and Exchange Commission and Department of Justice separately announced charges against individuals who reaped more than $194 million in illicit proceeds through an international stock manipulation scheme.

-

Article

ArticleSEC issues ‘highest penalty to date’ in data analytics case

The Securities and Exchange Commission credited its risk-based data analytics initiative for resulting in its “highest penalty to date” against a publicly traded company that engaged in improper accounting to boost its quarterly earnings per share.

-

Article

ArticleFormer tech exec to pay $97K for impeding SEC whistleblower

David Hansen, co-founder of Las Vegas-based software company NS8, agreed to pay $97,523 to settle charges from the Securities and Exchange Commission that he impeded a whistleblower’s attempt to communicate with the agency about a securities law violation.

-

Article

ArticleAA study: Cybersecurity breach disclosures surge in 2021

The number of cybersecurity breaches disclosed by public companies in 2021 increased 44 percent while reports of ransomware attacks also surged, according to the latest Audit Analytics study.

-

Article

ArticleBiden to nominate two for SEC commissioner openings

President Joe Biden announced his intention to nominate Jaime Lizárraga and Mark Uyeda for the Democratic and Republican commissioner openings, respectively, at the Securities and Exchange Commission.

-

Article

SEC proposes Dodd-Frank rule requiring security-based swaps to hire CCOs

The Securities and Exchange Commission proposed a regulatory framework for security-based swap execution facilities that will require these entities to hire a chief compliance officer to oversee compliance with new rules.

-

Article

ArticleNew bill seeks shorter wait for SEC whistleblower awards

The “SEC Whistleblower Reform Act of 2022” proposes to shorten the wait time for a whistleblower to receive a payout by requiring the Securities and Exchange Commission to issue an initial ruling on a claim within one year of the deadline to file the claim.

-

Article

ArticleQ1 roundup: SEC tackles climate disclosures, businesses navigate Russia restrictions, more

Regulation and guidance from U.S. agencies and the White House, plus compliance challenges stemming from a two-year global pandemic and Russia’s ongoing invasion of Ukraine, made the first quarter of 2022 a novel risk environment for regulated businesses.

-

Article

ArticleSenators call for close of private investment AML/CFT loophole

Sens. Sheldon Whitehouse (D-R.I.) and Elizabeth Warren (D-Mass.) called on the Treasury Department and SEC to close a “disconcerting loophole” that exempts hedge funds and other private investment firms from reporting suspicious activity within their transactions to authorities.

-

Article

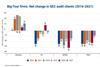

ArticleAudit client turnover 2021: Deloitte, Grant Thornton lead national firms; EY, KPMG, PwC see declines

Deloitte and Grant Thornton each had net increases in new public company audit clients in 2021, but all but one of the other Big Four and global and national firms experienced net decreases or no change, according to the latest annual study.

-

Article

ArticleBaidu headlines new batch of HFCAA designations

Technology giant Baidu is the latest high-profile Chinese company to be warned by the Securities and Exchange Commission of potential delisting under the Holding Foreign Companies Accountable Act.

-

Article

ArticleReported SEC probe of Big Four taking page from U.K. breakup plans?

The Securities and Exchange Commission is reportedly investigating whether large audit firm consulting services affect auditor independence. Any action taken might mirror the United Kingdom’s ongoing actions to break up the Big Four’s dominance.

-

Article

SEC names new acting head of Division of Examinations

Richard Best will become acting director of the Division of Examinations at the Securities and Exchange Commission, following the announced departure of Daniel Kahl.

-

Article

ArticleHow to prepare for SEC’s climate-related disclosure rule

The Securities and Exchange Commission’s proposed climate-related disclosure rule would force companies that have been reluctant to initiate a self-examination of their environmental impact to do so, posthaste. Experts weigh in on where to start.

-

Article

ArticleSEC adds Weibo to HFCAA watchlist

The Securities and Exchange Commission added Chinese social media giant Weibo Corp. to its list of companies not in compliance with the Holding Foreign Companies Accountable Act.