All articles by Paul Hodgson – Page 7

-

Article

Brexited: what lies ahead for the United Kingdom

The fallout continues after the United Kingdom’s historic vote to leave the European Union. As the reality of it sets in, Paul Hodgson looks at what Brexit will mean for the U.K. financial markets, political landscape, and compliance needs.

-

Blog

BlogFRC announces investigations into KPMG and PwC

The U.K. Financial Reporting Council, an independent investigative body that monitors and enforces accounting standards, is looking into audits made of financial services companies in the days preceding the global financial crisis of 2008-2009, starting with a delve into the work of two key accountancy firms—KPMG and PwC. Paul Hodgson ...

-

Blog

BlogA roadmap toward executive-level gender diversity in the U.K.

The United Kingdom’s struggle for executive-level gender diversity continues, especially in the financial services sector, where only 23 percent of board directors and only 14 percent of executive committee members are female. The Women in Finance Charter offers a roadmap for how to address this, with a stern warning: Organizations ...

-

Blog

Blog100 largest companies’ human rights to be ranked

When it comes to taking a stand for various human rights—including health & safety, land rights, water & sanitation, and women’s rights—there are 100 companies that stand out for standing up and doing the right thing, according to the Corporate Human Rights Benchmark. Paul Hodgson has more.

-

Article

New blood at the Serious Fraud Office

A report from Her Majesty’s Crown Prosecution Service Inspectorate has attacked the Serious Fraud Office for being a largely white, all-male board. Paul Hodgson examines the merits of the report and the SFO’s response.

-

Blog

BlogBrexit: ‘Don’t leave me this way’

“Don’t leave me this way,” screams a headline from Dutch daily Algemeen Dagblad. The Netherlands fears Britain’s exit will be bad for its reputation. Paul Hodgson reports.

-

Blog

Financial reporting has room for improvement, says KPMG

A recent KPMG report underscores some pretty widespread deficiencies when it comes to business reporting. Whether companies are failing to note the impact of new products or how much injury time they have suffered, most can stand to improve the state of their annual reports. Paul Hodgson has more survey ...

-

Blog

Five-step guide to human rights due diligence

The U.K. Equality and Human Rights Commission has issued a five-step guide aimed at British boards and intended to help businesses “identify, mitigate, and report on the human rights impacts of their activities.” Paul Hodgson reports.

-

Blog

BlogFrench nay on pay-cut

The controversy over Renault CEO Carlos Ghosn’s (pictured above) 2015 €7.2 million remuneration likely sparked revisions to France’s rules on compensation—including making say-on-pay mandatory and strengthening transparency rules. But so far, says Global Glimpses writer Paul Hodgson, Renault has no plans to change Ghosn’s compensation.

-

Blog

FCA advises on new EU Market Abuse Regulation

The Financial Conduct Authority has published changes to its handbook, “Disclosure Guidance and Transparency Rules,” to help U.K.-listed companies comply with new EU Market Abuse Regulation (MAR) from 3 July this year. The handbook and MAR cover a very wide range of “market abuse” issues, such as insider dealing, improper ...

-

Blog

FCA must not drop the ball on banking culture reforms

The U.K. Parliament’s Public Accounts Committee has issued a report that is not only deeply critical of the FCA’s decision to suspend its culture review of banks but also warns of “serious risks” of future mis-selling scandals. Paul Hodgson examines the report’s impact on U.K. bank culture.

-

Blog

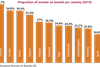

BlogWomen on boards: non-executive progress, executive stagnation

A new study of female representation on boards ranks Norway first, with women comprising, on average, 38.7 percent of total board membership. Switzerland ranks dead last, with average representation of women at just 16.1 percent. Paul Hodgson provides an in-depth look at the results.

-

Article

Is this U.K. Shareholder Spring III?

Amid numerous shareholder revolts at U.K. companies over executive pay, Paul Hodgson examines how, since pay votes became binding two years ago, the shareholders themselves are wasting no time to exercise their power in which might be less of a demonstration and more of a revolution.

-

Blog

BlogHave your say on the new Sustainability Reporting Standards

Stakeholders have 90 days from 19 April to comment on the initial set of six GRI Sustainability Reporting Standards to the Global Sustainability Standards Board, which has been commissioned to develop and approve the rules. The new standards cover subjects and disclosures from earlier guidance in G4, but will be ...

-

Blog

Oxfam’s Big 10 food companies: progress, but more to be done

An Oxfam report ranking the “Big 10” on seven core issues says firms need to ensure suppliers change their practices to align with commitments; adopt supply chain business models that guarantee power reaches those who produce ingredients; and more. Paul Hodgson has the score.

-

Article

Is the French governance code about to become more shareholder-friendly?

Image: French financial markets regulator Autorité des Marchés Financiers has issued a report comparing countries’ various corporate governance codes, and it looks as if France has some work to do. While the AMF won’t be rewriting France’s code, says spokeswoman Christèle Fradin, it would like their suggestions taken into account, ...

-

Blog

BlogFRC: What investors should expect in company records

Stephen Haddrill, chief executive of the U.K.’s Financial Reporting Council, wrote a letter to investors highlighting recent changes to companies’ annual reports and advising investors on what to expect in the coming crop. The report is “intended to be an important source of forward-looking information about strategy and risk,” he ...

-

Blog

New EU auditor rotation rules have auditors playing musical chairs

Are companies ready for new EU-wide auditor rules coming in June? A survey commissioned by Big Four firm EY of 100 senior-level executives and non-executives in the FTSE 350 finds that while a majority, 83 percent, understands the rotation rules, only 42 percent have a plan in place. More than ...

-

Blog

Beyond complying with the Modern Slavery Act

Companies troubling over how to report due diligence procedures on eliminating human trafficking under the U.K. Modern Slavery Act have been given some help. A new guide from U.K.-based civil society organizations advises companies on how to embed such procedures into their reports. Although the reports are certainly important, says ...

-

Article

Loyalty shares v. one share – one vote: The Florange Act

France will experience a sea change in voting rights next month with the passage of the Florange Act. Adopted in 2014, the Act provides for the automatic granting of double-voting rights to stock held by shareholders for at least two years in a row. Rients Abma, executive director of Eumedion, ...