All Boards & Shareholders articles – Page 18

-

Blog

BlogWomen on boards: non-executive progress, executive stagnation

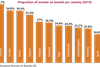

A new study of female representation on boards ranks Norway first, with women comprising, on average, 38.7 percent of total board membership. Switzerland ranks dead last, with average representation of women at just 16.1 percent. Paul Hodgson provides an in-depth look at the results.

-

Article

Is this U.K. Shareholder Spring III?

Amid numerous shareholder revolts at U.K. companies over executive pay, Paul Hodgson examines how, since pay votes became binding two years ago, the shareholders themselves are wasting no time to exercise their power in which might be less of a demonstration and more of a revolution.

-

Blog

Mutual funds call for corporate board accountability

As proxy season begins, holding boards accountable is the new black, and issues such as proxy access and dual-class companies are giving critics and activist shareholders new avenues for holding corporate board members’ feet to the fire. More from Stephen Davis and Jon Lukomnik.

-

Blog

Study: CEO pay had lowest increase since financial crisis

Total median CEO pay, excluding pensions, at large capital U.S. companies grew just 3.9 percent, the lowest increase since the financial crisis of 2008. That’s the conclusion drawn in a new study by ISS Corporate Solutions, a subsidiary of Institutional Shareholder Services, a leading proxy advisory firm.

-

Blog

Seven myths of boards of directors

Various myths surround corporate governance, especially when it comes to the accusations levied by institutional investors and others on the governance scene. CW columnist Rick Steinberg examines three such myths in the first of a two-part series, as he addresses to what degree accusers are seeking to hold boards to ...

-

Blog

Nasdaq acquires Boardvantage

Nasdaq this month entered into a definitive agreement to acquire Boardvantage, a board portal solution provider that also specializes in leadership collaboration and meeting productivity, for $200 million. The acquisition of Boardvantage, along with the recently closed purchase of Marketwired, is expected to strengthen Nasdaq's position as a global ...

-

Blog

SEC requires ExxonMobile, Chevron climate change resolutions

The SEC has denied efforts by ExxonMobil and Chevron to exclude shareholder resolutions seeking additional disclosures related to climate change. The decision was detailed in recent no-action letters issued by the Division of Corporation Finance. A coalition of investors want the companies to “stress test” and disclose the effect ...

-

Blog

Under investor scrutiny, corporate governance evolved into a crucial value generator

Title: Recent statements from big, maRecent statements from big, mainstream investment firms underscore just how far corporate governance has evolved from having once been a compliance exercise about proxies to a fundamental contributor to risk management and value creation. And as more funds integrate environmental, social, and governance factors into ...

-

Article

Buffett vs. Zuckerberg: Does CEO age matter to investors?

Plenty of research supports the notion of mandatory retirement age for board members, but what about MRPs for CEOs? Does imposing an age limit on top executives really drive better long-term organizational performance? Shareholders, it turns out, seem to prefer experience to youth.

-

Article

GE unveils new approach to investor reporting

GE might seem an unlikely company to take a lead in the push to simplify financial disclosures. A multinational conglomerate with a long list of business lines, its inherent complexity might seem to make it ill-suited for such a task. And yet, GE is aggressively taking the lead, notably with ...

-

Article

Pax World’s Joe Keefe on how ESG continues to go mainstream

Image: The 2016 proxy season, building upon trends that emerged from last year’s annual meetings, may prove to be pivotal for investors focused on sustainability, diversity, and environmental issues. “I’ve seen more uptake in the last 18 months than I’ve seen in the previous 17 years,” says Joe Keefe, president ...

-

Blog

BDO USA weighs in with proxy season advice

Volatility and risk around the globe is fostering uncertainty in corporate boardrooms around the country, and the “unsettled climate should make for an interesting annual meeting season,” says a new report by BDO USA, an accounting and consulting firm. The firm has compiled a list of topics that corporate management ...

-

Article

Proxy season debates may include board scrutiny and short-termism

With proxy season just around the corner, the annual tradition of assessing the mood of investors has begun. On tap, experts say, are demands for improved transparency and communication, better disclosures, and a continuing scrutiny of directors, including how (and how much) they and their C-suite cohorts are compensated. “We ...

-

Article

Women on U.K. boards: A (partial) success story

Corporate boards across the United Kingdom continue to have low numbers of women on them, suggesting that the struggle to increase board diversity is going slower than planned. But progress is indeed being made, all while raising the difficult questions as to why it is not so easy to build ...

-

Blog

The state of “Emperor’s New Clothes” corporate disclosure

Capital markets move on information. And business in general improves in a competitive world when oversight is grounded in meaningful data. That’s why transparency in disclosure is such a good thing. But what we have now is bland compliance, not insightful communication, and it’s pretending that something exists when it’s ...

-

Article

ArticleNASDAQ rule could tug on the ‘golden leash’ of activist directors

So-called “golden leash” arrangements occur when activist shareholders—typically hedge funds—pay a director or board nominee in connection with their service. Calling them “one area where investors may not have complete information,” NASDAQ submitted a rule proposal to the SEC that would require listed companies to disclose these arrangements. A more ...

-

Blog

Survey: public underestimates CEO pay, still outraged

Image: A recent survey of 1,202 individuals by Stanford University’s Rock Center for Corporate Governance shows the American public believes CEOs take home much more in compensation than they deserve. “While we find that members of the public are not particularly knowledgeable about how much CEOs actually make in annual ...

-

Blog

PwC and LRN Forge Strategic Relationship to Elevate Corporate Values

PwC and LRN have announced a long-term strategic relationship to better help organizations elevate behavior, define and scale their values. Together, the PwC network of firms and LRN will develop innovative solutions in governance, culture and leadership, and in areas such as strategy, talent, forensic investigations, enterprise risk management, and ...

-

Blog

ISS Updates Guidance on Executive Compensation Policies

Leading proxy adviser ISS has updated guidance, in the form of “frequently asked questions,” regarding its approach to executive compensation policies. The document is intended as a general discussion about the way ISS will analyze certain issues in the context of preparing proxy analyses and determining vote recommendations for U.S. ...

-

Blog

Pale, Male, and Stale

The call for greater boardroom diversity is not merely a matter of political correctness; it’s a matter of modern business planning, and most of all, a matter of regulatory compliance. And yet, despite the strides being made here, there is still much more ground to cover, and progress seems to ...