Articles | Compliance Week – Page 71

-

Article

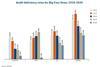

ArticlePCAOB 2020 inspection reports: PwC bucks deficiency trend, dethrones Deloitte

PwC ended its three-year run of increasing deficiency percentages to boast the lowest rate among Big Four firms in the PCAOB’s 2020 inspection reports—the first time Deloitte hasn’t performed best since 2016.

-

Article

ArticleCredit Suisse to overhaul strategy: ‘Risk management will be at the core of our actions’

Credit Suisse announced sweeping changes to its long-term growth strategy, reemphasizing risk management after missed red flags led to billions of dollars in losses related to the collapses of Archegos Capital Management and Greensill Capital.

-

Article

ArticleNYDFS first state banking regulator to establish Climate Risk Division

The New York State Department of Financial Services announced the creation of a new Climate Risk Division to oversee regulated entities’ efforts at managing the financial risks of climate change.

-

Article

ArticleEx-FIFA president facing fresh fraud charges

Former FIFA officials Sepp Blatter and Michel Platini have been charged with fraud, forging documents, and other offenses following a six-year investigation into a controversial CHF 2 million (U.S. $2.2 million) payment made out to Platini a decade ago.

-

Article

ArticleSurvey: More financial institutions using scenario analysis to manage climate risk

Financial institutions are growing more sophisticated in the way they incorporate scenario analysis into their risk assessments and in quantifying their climate-related risks, a new survey from the Global Association of Risk Professionals finds.

-

Article

Zimmer Biomet chief accounting officer to depart

Medical device company Zimmer Biomet Holdings announced the departure of Vice President, Controller and Chief Accounting Officer Carrie Nichol, effective Nov. 26.

-

Article

Banner Corp. hires chief risk officer

Bank holding company Banner Corp. has hired Jim Costa to replace the retiring Judy Steiner as executive vice president and chief risk officer of Banner Bank.

-

Article

ArticleRoisman: SEC should consider stricter cyber reporting for public companies, advisers

SEC Commissioner Elad Roisman says the agency should mull over whether to require public companies and investment advisers to perform the same kind of reporting, preparation, and planning for cyber incidents that FINRA requires of registered broker-dealers.

-

Article

ArticleBanks in crisis at CEO turning to chief risk officers

Two of the largest banks in Europe—Barclays and Danske Bank—have had to make abrupt pivots at the CEO position this year. Each has chosen to pass the baton to their former chief risk officer.

-

Article

ArticleGrant Thornton UK fined for ‘skepticism failures’ in Interserve audit

Grant Thornton UK received a “severe reprimand” and reduced penalty of £718,250 (U.S. $981,000) for breaches that arose in the context of audit work on the 2015-17 financial statements of now-collapsed construction firm Interserve.

-

Article

ArticleBarclays CEO Jes Staley steps down over Jeffrey Epstein links

Barclays CEO Jes Staley stepped down after a probe by British financial regulators looks to have found evidence his friendship with disgraced sex offender Jeffrey Epstein was closer than he had originally made out.

-

Article

ArticleCFPB picks consumer advocate Eric Halperin to lead enforcement

Newly confirmed CFPB Director Rohit Chopra has chosen Eric Halperin to lead the agency’s Office of Enforcement, as well as announcing the appointment of Lorelei Salas as assistant director for supervision policy.

-

Article

ArticleSEC awards whistleblower extra $2M for DOJ action

The Securities and Exchange Commission announced a second award to a whistleblower after their information provided led to a successful related action by the Department of Justice.

-

Article

ArticleDOJ vows stricter white-collar enforcement, increased risk of monitors

Deputy Attorney General Lisa Monaco shares actions the Department of Justice will be taking to strengthen its response to corporate crime and what areas it will be looking at moving forward.

-

Article

ArticleFASB update addresses revenue recognition in business combinations

The Financial Accounting Standards Board announced an update to its business combinations standard aimed at clarifying how to apply requirements under its revenue recognition rule.

-

Article

ArticleFICC fined $8M for failing to monitor, vet liquidity of transactions

The Fixed Income Clearing Corporation, the clearing agency for all U.S. government securities, agreed to an $8 million settlement with the SEC for failing to adequately monitor its liquidity arrangements.

-

Article

ArticleRohit Chopra-led CFPB cracking down early on data, automation

Rohit Chopra has led the Consumer Financial Protection Bureau for less than a month, but one area of examination and enforcement priority is already coming into focus: data.

-

Article

ArticleEx-Walmart CECO joins McKinsey as chief compliance officer

Daniel Trujillo, the former executive vice president and global chief ethics and compliance officer at Walmart, announced his joining management consulting firm McKinsey & Co. as chief compliance officer.

-

Article

Renamed Wells Fargo unit Allspring Global Investments hires chief compliance officer

Asset management firm Allspring Global Investments, the upcoming new name for what used to be Wells Fargo Asset Management, has hired Chris Baker as chief compliance officer, effective January 2022.

-

Article

Linklaters appoints general counsel

Law firm Linklaters has appointed Michael Bennett as general counsel.