All Accounting & Auditing articles – Page 109

-

Blog

Audits Failures Linked to Execution, Not Process Problems

Image: Dec. 10—Audits fail not so often because the audit firm’s process was flawed, but because individual auditors or engagement teams fail to adhere to firm methodologies, according to Jay Hanson, a member of the PCAOB. At a national accounting conference on regulatory issues, Hanson said he sees much more ...

-

Blog

FASB Studies Three Revenue Issues for Possible New Guidance

Image: Financial Accounting Standards Board Chairman Russ Golden has authorized FASB staff to conduct research on (1) how to apply the new revenue recognition standard to licensing agreements; (2) when revenue should be recognized on a gross versus net basis; and (3) how to determine performance obligations. The research should ...

-

Article

Frameworks and Leadership on Cyber-Risks

As cyber-security attacks become everyday news, companies are racing to identify and mitigate their risks. Some of that is “pure” IT security; much of it is about applying a control framework smartly to new technologies—and empowering the right person to oversee these risks. “Companies ... for the most part are ...

-

Blog

Janus, COSO, FCPA Compliance and Enforcement

The U.S. Sentencing Guidelines have long been one path to kinder treatment from the Justice Department for FCPA violations. On the civil side enforced by the SEC, something similar may be emerging: the COSO 2013 framework for effective internal control. How different are those two paths? Not as much as ...

-

Blog

SEC, PCAOB Deliver Fresh Warnings on Auditor Independence

Dec. 9—Public companies have been handed a not-so-subtle reminder to pay closer attention to auditor independence. At the annual AICPA conference this week, the SEC announced it had sanctioned eight audit firms with fines totaling $140,000 for violating auditor independence rules because they prepared financial statements of brokerage firms whose ...

-

Blog

BlogSEC Declining to Comment (in Letters)

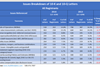

The number of SEC comment letters regarding 10-Ks and 10-Qs issued during the first six months of 2014 decreased about 25 percent compared to the same period in 2013, according to Audit Analytics. In our latest guest post from the firm, Audit Analytics look at the most comment types of ...

-

Blog

PCAOB Finds No Big Improvement in 2014 Inspections

Image: The Public Company Accounting Oversight Board will soon offer a peek at 2014 inspection findings, but you won’t see much improvement, said Chairman James Doty. The board has delivered consistently tough marks to the major audit firms in recent years, calling for better audit work on such items as ...

-

Blog

SEC Explores Possible Option to Report Under IFRS

Image: The Securities and Exchange Commission is exploring whether to provide U.S. companies with the option to present their financial statements under International Financial Reporting Standards, SEC Chief Accountant James Schnurr said last week. Schnurr is studying the staff’s historical work on a possible adoption of IFRS, and reaching out ...

-

Blog

IT Experts Offer Updated Guidance on IT Controls

Image: Companies struggling with information technology controls may gain tips from ISACA’s new guidance on scoping and assessment ideas for IT-related aspects of the COSO framework. “This latest guide will help professionals align with these changes in the industry,” said Ken Vander Wal, former ISACA president.

-

Blog

CAQ Reminds Auditors of Hot-Button Audit Issues

Image: A new Center for Audit Quality alert highlights issues that auditors will need to pay special attention to in the year-end review, such as revenue recognition, related-party transactions, and more. “This alert summarizes potential areas of risk and can be a useful resource for our auditing firm members as ...

-

Blog

BDO USA, Crowe Horwath Get Varied PCAOB Inspection Results

The Public Company Accounting Oversight Board published inspection findings for two major firms, giving them much different marks for their 2013 audit work. At BDO USA, inspectors found deficiencies in 15 of 23 audit files, a 55 percent increase in problems from 2012. At Crowe Horwath inspectors checked only 13 ...

-

Blog

Former Federal Reserve Deputy Director Joins KPMG

Deborah Parker Bailey, former Federal Reserve deputy director, has joined KPMG’s New York office as a managing director in its regulatory risk service network. Bailey’s arrival adds to the firm’s regulatory risk team that provides strategic insight to KPMG’s financial services clients on regulations affecting their business and helps to ...

-

Blog

Audit Committees Offer Details on Auditor Independence

Image: A Center for Audit Quality study shows a significant majority of all S&P Composite 1,500 companies are talking to investors about auditor independence, but fewer address how the auditor is appointed. “We think it is important to provide a baseline for audit committee disclosures, with the intent of tracking ...

-

Article

ArticleAre Auditors Making Unnecessary Demands on Internal Control Documentation?

As many companies finish work on a new framework for internal controls, a small number of them are starting to question their external auditors’ documentation requirements and are considering pushing back. Lillian Barlett, vice president of risk management and internal audit at SunOpta, for example, says the documentation requests are ...

-

Article

Hidden Complexity in the New Rules for Revenue Recognition

Financial reporting and auditing experts are warning companies of surprises they may encounter as they continue to work their way through 700 pages of new accounting rules on how to recognize revenue in their financial statements beginning in 2017. The accounting standard update requires several new disclosures, for example. “There ...

-

Blog

Ideas for Guidance on Auditing Estimates Draw Mixed Reviews

The Public Company Accounting Oversight Board is getting mixed feedback on its initial ideas for revising guidance on auditing fair-value measurements and accounting estimates. The PCAOB has received nearly 40 letters on the staff's consultation paper on the topic, some suggesting a revision of existing rules, while others suggest a ...

-

Article

COSO Framework Has Applications Beyond Financial Reporting

Image: As companies put the finishing touches on the adoption of the updated framework for internal controls, many are realizing that there are hidden benefits to the work. Audit experts say there are several other areas where elements of the updated COSO framework can apply, such as divisional reporting, customer ...

-

Blog

Your 10-K Is Too Long; Here’s How to Shorten It

Chances are your annual and quarterly financial reports are too long, and it’s not just that regulators and rulemakers require too much information. Lots of words in your filings are neither useful nor required. Since they aren’t important or necessary, take them out. Inside, columnist Scott Taub makes some suggestions ...

-

Blog

Golden Answers Early Political Pressure on Revenue Recognition

To answer early political pressure over the new accounting standard on revenue recognition, the Financial Accounting Standards Board is pledging its readiness to work through implementation issues as they are identified and brought to the board for action.